Guest

Guest

|  Subject: WE ARE BEING WARNED THAT THE LAST WEEK OF AUGUST “COULD BE HIGHLY VOLATILE” FOR GLOBAL FINANCIAL MARKETS Subject: WE ARE BEING WARNED THAT THE LAST WEEK OF AUGUST “COULD BE HIGHLY VOLATILE” FOR GLOBAL FINANCIAL MARKETS  Mon Aug 26, 2019 10:17 am Mon Aug 26, 2019 10:17 am | |

| https://www.shtfplan.com/headline-news/we-are-being-warned-that-the-last-week-of-august-could-be-highly-volatile-for-global-financial-markets_08262019WE ARE BEING WARNED THAT THE LAST WEEK OF AUGUST “COULD BE HIGHLY VOLATILE” FOR GLOBAL FINANCIAL MARKETSMichael Snyder

August 26th, 2019

The Economic Collapse Blog

Read by 156 peopleThis article was originally published by Michael Snyder at The Economic Collapse Blog. Are things about to break loose in a major way? At the end of last week, the trade war between the United States and China escalated dramatically, and investors all over the globe really started freaking out.Unfortunately, developments over the weekend have only made things worse, and that means that this could be a very “interesting” week for global financial markets. As I write this article, stock prices around the world are plunging, the price of gold is spiking and the Chinese yuan is crashing. There is clearly a lot of fear out there right now, and at this point, even CNBC is warning that the last week of this month “could be highly volatile”… - Quote :

- The final week of August — the bittersweet end of summer for many— could be highly volatile, as markets fret over the economy and the latest developments in trade wars.

Of course, things can swing rapidly from moment to moment in this environment. President Trump could say something in a few hours that temporarily gives investors some hope, and that could cause markets to swing wildly upward for a little while. Everyone is on edge right now, and every piece of significant news is likely to cause gyrations in the marketplace.But overall the trend is clearly down. U.S. stocks have now fallen for four weeks in a row, and many are becoming deeply concerned about what September will bring.And for many U.S. businesses, this trade war has turned into a complete nightmare. Executives crave predictability, but now everywhere we look there is chaos, and this is causing a lot of headaches for business leaders… - Quote :

- Businesses crave predictability so they can make informed decisions and plan for the future. Many companies that depend on Chinese manufacturers and consumers have already shifted supply chains out of the country and taken other steps to reduce their exposure to China. And while Mr. Trump’s tweets are unlikely to trigger immediate changes, more uncertainty is unwelcome.

“Continued escalation and rhetoric are harmful to American businesses, workers and farmers,” said Tom Linebarger, chief executive of Cummins Inc., which makes diesel engines. Cummins pays a tariff on components it imports from its own plants in China for engines assembled at U.S. factories by American workers. The tariffs amount to a tax paid by Cummins’ customers, he said. Unfortunately, nobody can no longer deny that global economic activity is really starting to slow down. We just learned that global trade was down 1.4 percent in June from a year earlier, and that represented the largest decline that we have seen since the last financial crisis… - Quote :

- World trade volume – a measure of imports and exports of merchandise across the globe – declined in its zigzag manner in June to the lowest level since October 2017, according to the Merchandise World Trade Monitor by CPB Netherlands Bureau for Economic Policy Analysis. The index was down 1.4% from June 2018. This small year-over-year decline is the biggest year-over-year decline since the Financial Crisis, and it’s a reversal from the heady growth in 2017 and 2018 that had topped out at 6.7%.

I have been using phrases like “since the last financial crisis” and “since the last recession” in almost every article recently. We are seeing so many things happen that we haven’t seen for a decade or longer, and yet most Americans still don’t seem to understand that we have a real crisis on our hands.If the U.S. and China were to mend their relationship and agree to a comprehensive trade deal, that would certainly help things.Unfortunately, that isn’t going to happen.In fact, both sides appear to be digging in even more. For example, the White House just told us that President Trump “regrets not raising the tariffs higher”… - Quote :

- When asked if Trump had second thoughts about Friday’s move to escalate the trade war with China, Trump said “Yup.” “I have second thoughts about everything,” he added.

Hours later, the White House issued a statement saying that Trump meant to say that he wished he had raised tariffs on Beijing even higher.

“His answer has been greatly misinterpreted. President Trump responded in the affirmative – because he regrets not raising the tariffs higher,” White House spokeswoman Stephanie Grisham wrote in a statement. And the Chinese are warning that we should not “underestimate the determination” of the Chinese people and that they will be the ones to “have the last laugh”… - Quote :

- On Saturday, China’s commerce ministry issued a statement calling on Washington not to “misjudge the situation and underestimate the determination of Chinese people” after US President Donald Trump announced new tariffs on Chinese imports.

“The US should immediately stop its wrong action, or it will have to bear all consequences,” the statement said.

At the same time, a sharply worded commentary in the official party mouthpiece, People’s Daily, said China had the strength to continue the dispute and accused Washington of sacrificing the interests of its own people. Published under the pseudonym “Wuyuehe”, the piece described the latest tariff measures by the US as “barbaric”. The op-ed said China’s own tariffs on $75 billion worth of American products, announced late on Friday, were a response to America’s unilateral escalation of the trade conflict, and vowed that China was determined to fight back “until the end”.

“China’s will to defend the core interests of the country and the fundamental interests of the people is indestructible, and will not fear any challenge,” the author wrote, promising that “history will prove that the side on the path of fairness and justice will have the last laugh.” As I have repeatedly warned, there isn’t going to be a trade deal before the 2020 presidential election.So that means that things are going to get progressively worse, and we need to be prepared for a lot of economic pain.At this point, even U.S. Senator Lindsey Graham is telling us that the American people are just going to have to “accept the pain that comes with standing up to China”… - Quote :

- Sen. Lindsey Graham, R-S.C., said on Sunday that Democrats should not criticize President Trump for taking on China over trade as they have complained for years about Beijing’s policies but done nothing.

“Every Democrat and every Republican of note has said China cheats,” Graham said on CBS News’ “Face the Nation.” “The Democrats for years have been claiming that China should be stood up to, now Trump is and we’ve just got to accept the pain that comes with standing up to China.” Sadly, the truth is that the American people are not well equipped to deal with pain. We have been spoiled by decades of debt-fueled “prosperity”, and even a relatively minor economic downturn would result in a massive national temper tantrum.Right now our nation is a seething cauldron of anger and frustration, and the mainstream media is stirring the pot on a daily basis. It isn’t going to take much to spark an explosion, and this will especially be true the closer we get to the next presidential election.PRESIDENT TRUMP IS BREAKING DOWN THE NECK OF THE FEDERAL RESERVE!He wants zero rates and QE4!You must prepare for the financial resetWE ARE RUNNING OUT OF TIMEDOWNLOAD THE ULTIMATE RESET GUIDE NOW!Author: Michael SnyderThe season of “the perfect storm” is upon us, and what is coming next is going to be one of the most chaotic chapters in modern American history.Michael Snyder is a nationally-syndicated writer, media personality and political activist. He is the author of four books including Get Prepared Now, The Beginning Of The End and Living A Life That Really Matters.His articles are originally published on The Economic Collapse Blog, End Of The American Dream and The Most Important News.Author: Michael SnyderViews: Read by 156 people

Date: August 26th, 2019

Website: http://theeconomiccollapseblog.com

Copyright Information: This content has been contributed to SHTFplan by a third-party or has been republished with permission from the author. Please contact the author directly for republishing information. |

|

Guest

Guest

|  Subject: Core Durable Goods Orders Disappoint As Shipments Slump Most In 3 Years Subject: Core Durable Goods Orders Disappoint As Shipments Slump Most In 3 Years  Mon Aug 26, 2019 10:20 am Mon Aug 26, 2019 10:20 am | |

| YOU NEED SOMETHING, GET NOW, SHORTAGES OR NOTHING AVAILABLE PLANNED? https://www.zerohedge.com/news/2019-08-26/core-durable-goods-orders-disappolint-shipments-slump-most-3-years

Core Durable Goods Orders Disappoint As Shipments Slump Most In 3 Years

[size=10][size=10]by Tyler Durden

Mon, 08/26/2019 - 08:40[/size]

Pri

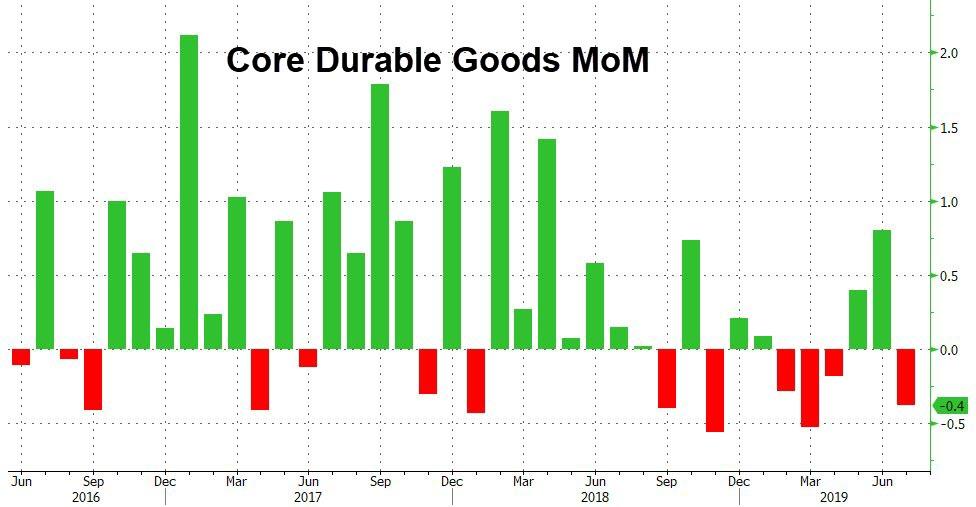

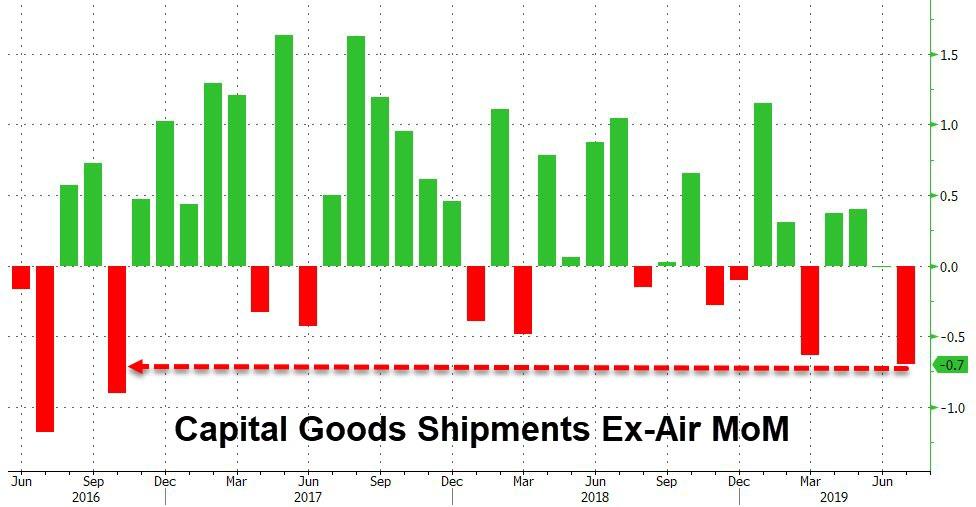

Despite a headline beat (juiced by huge and volatile surges in defense and non-defense aircraft orders), core durable goods orders disappointed and capital goods shipments (ex-Air) slumped by the most since Oct 2016.

Durable Goods Orders rose 2.1% MoM (well above the 1.2% rise expected) and YoY, durable goods rebounded into the positive...

Source: Bloomberg

Much of the surprise was driven by gains in aircraft orders:

[/size]

- nondefense aircraft and parts new orders +47.8%

- defense aircraft and parts new orders +34.4%

[size][size] But core durable goods orders disappointed (falling 0.4% MoM against expectations of no change)...  Source: Bloomberg Source: BloombergAnd moreover, shipments (ex-Air) fell by 0.7% MoM - the biggest drop since Oct 2016...  Source: Bloomberg Source: BloombergThe slump in sales of equipment suggests American businesses remained cautious about capital spending ahead of this month’s escalation of the U.S.-China trade war. The report compares with recent data that signal further cracks in the manufacturing sector. Markit's PMI posted its first contraction since 2009, and the Kansas City Fed's factory gauge shrank.[/size] [/size] |

|

Guest

Guest

|  Subject: PAY ATTENTION !!!! NATIONAL EMERGENCY / PRES / ECONOMIC POWERS ACT = YES HE CAN! Subject: PAY ATTENTION !!!! NATIONAL EMERGENCY / PRES / ECONOMIC POWERS ACT = YES HE CAN!  Mon Aug 26, 2019 11:29 am Mon Aug 26, 2019 11:29 am | |

| ECONOMIC POWERS ACT

https://thedailycoin.org/2019/08/26/dog-day-video-ipot/

[size=31]DOG DAY (Video) – IPOT[/size]

BY IPOT · AUGUST 26, 2019

DOG DAY (Video) – IPOT

https://www.bitchute.com/video/Cj7layREyG4x/ |

|

Dove

Super Elite

Posts : 90999

Reputation : 524

Join date : 2011-08-18

|  Subject: Re: WE ARE BEING WARNED THAT THE LAST WEEK OF AUGUST “COULD BE HIGHLY VOLATILE” FOR GLOBAL FINANCIAL MARKETS Subject: Re: WE ARE BEING WARNED THAT THE LAST WEEK OF AUGUST “COULD BE HIGHLY VOLATILE” FOR GLOBAL FINANCIAL MARKETS  Mon Aug 26, 2019 12:08 pm Mon Aug 26, 2019 12:08 pm | |

| Volatile? Worse than last week?  Trump's got them freaking out and they don't like not being able to manipulate it THEIR WAY. Awwww. I do feel awful for people in 401K's though. We should buy stock in TUMS. LOL. And forget about long term

I want to know the thoughts of God. Everything else is just details.

A Miracle is when God makes His Reality our Experience

| |

|

Sponsored content

|  Subject: Re: WE ARE BEING WARNED THAT THE LAST WEEK OF AUGUST “COULD BE HIGHLY VOLATILE” FOR GLOBAL FINANCIAL MARKETS Subject: Re: WE ARE BEING WARNED THAT THE LAST WEEK OF AUGUST “COULD BE HIGHLY VOLATILE” FOR GLOBAL FINANCIAL MARKETS  | |

| |

|